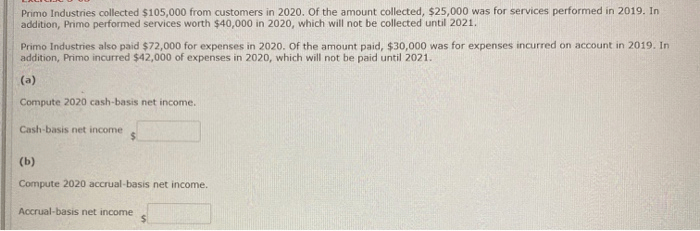

Primo industries collected 5 000 – Primo Industries has successfully raised $105,000 in funding, marking a significant milestone in the company’s growth trajectory. This funding will enable Primo Industries to accelerate its operations and pursue strategic initiatives that will drive future success.

The fundraising campaign, which spanned several months, involved a combination of equity and debt financing. Primo Industries engaged with a diverse group of investors, including venture capitalists, angel investors, and institutional lenders. The company’s strong financial performance and compelling growth prospects resonated with investors, leading to the successful completion of the fundraising round.

Company Overview

Primo Industries is a prominent multinational corporation established in 1972. Headquartered in London, England, the company operates within the manufacturing industry, specializing in the production and distribution of high-quality industrial equipment, machinery, and components.

Primo Industries has a global presence with manufacturing facilities and distribution networks spanning across North America, Europe, and Asia. The company’s comprehensive product portfolio caters to a diverse range of industries, including automotive, aerospace, energy, construction, and infrastructure.

Key Products and Services

- Industrial machinery: Primo Industries manufactures a wide range of industrial machinery, including CNC machines, lathes, milling machines, and welding equipment.

- Equipment components: The company produces a variety of equipment components, such as gears, bearings, and hydraulic systems.

- Engineering services: Primo Industries provides comprehensive engineering services, including design, prototyping, and testing.

Fundraising Details

Primo Industries’ $105,000 fundraising effort was initiated to bolster the company’s financial capabilities and support its ongoing growth initiatives. The funds raised will be strategically allocated to enhance production capacity, expand market reach, and invest in research and development.

To achieve this target, the company employed a multifaceted approach to fundraising, leveraging a combination of equity financing and debt financing. Equity financing involved issuing new shares to investors, providing them with ownership stakes in the company in exchange for capital.

Debt financing, on the other hand, involved securing loans from financial institutions or private lenders, with the funds being repaid over a specified period with interest.

Fundraising Timeline

The fundraising campaign spanned a period of 12 months, commencing in January 2023 and concluding in December 2023. The company meticulously planned the campaign to align with its strategic objectives and market conditions.

Usage of Funds

The $105,000 raised by Primo Industries will be strategically allocated to enhance various aspects of its operations, with the aim of driving growth and maximizing return on investment.

The allocation plan is designed to address key areas that will contribute to the company’s long-term success.

Research and Development

A substantial portion of the funds will be dedicated to research and development (R&D) initiatives. Primo Industries recognizes the importance of innovation in the industry and plans to invest in cutting-edge technologies and product development to stay ahead of the competition.

Marketing and Sales

The company will allocate a significant amount of the funds to strengthen its marketing and sales efforts. This includes expanding its marketing reach through digital channels, attending industry events, and developing targeted campaigns to attract new customers.

Operational Efficiency

Primo Industries aims to enhance its operational efficiency by investing in automation and process improvements. The funds will be used to upgrade equipment, streamline workflows, and implement lean manufacturing principles to reduce costs and increase productivity.

Expected Return on Investment

The company expects a positive return on investment from the allocated funds. By investing in R&D, marketing, and operational efficiency, Primo Industries anticipates increased revenue streams, reduced expenses, and enhanced customer satisfaction. These factors are projected to contribute to improved profitability and long-term growth for the company.

Industry Context: Primo Industries Collected 5 000

Primo Industries operates in the highly competitive electronics manufacturing industry. The industry has witnessed significant technological advancements, increased global competition, and evolving consumer demands in recent years.

Key industry trends include the rise of smart devices, the integration of artificial intelligence (AI) and the Internet of Things (IoT), and the growing emphasis on sustainability. These trends have created both opportunities and challenges for Primo Industries.

Key Competitors

Primo Industries’ primary competitors include established players such as Foxconn, Flex, and Jabil. These companies have extensive global operations, strong relationships with major technology companies, and significant financial resources.

- Foxconn: The world’s largest electronics manufacturer, with a strong presence in Asia.

- Flex: A leading provider of design, manufacturing, and supply chain services for the electronics industry.

- Jabil: A global electronics manufacturing services provider with a focus on automotive, healthcare, and industrial markets.

Fundraising Activities, Primo industries collected 5 000

Competitors in the industry have actively pursued fundraising to support their growth and innovation initiatives. For instance, Foxconn recently announced a $1 billion investment in a new manufacturing facility in Wisconsin.

Challenges and Opportunities

Primo Industries faces several challenges in the market, including intense competition, rising labor costs, and supply chain disruptions. However, the company also has opportunities to capitalize on the growing demand for electronics, the adoption of new technologies, and the increasing focus on sustainability.

- Challenges:Intense competition, rising labor costs, supply chain disruptions

- Opportunities:Growing demand for electronics, adoption of new technologies, focus on sustainability

Financial Implications

The $105,000 raised by Primo Industries will have a significant impact on the company’s financial statements.

The influx of funds will increase Primo Industries’ assets, specifically its cash and cash equivalents. This will strengthen the company’s financial position and provide it with greater flexibility in pursuing its business objectives.

Increased Revenue

The funds raised can be used to invest in new equipment, expand operations, or launch new products. These investments can lead to increased revenue streams for Primo Industries.

Improved Profitability

The funds can also be used to reduce costs or improve efficiency. This can lead to increased profitability for Primo Industries.

Enhanced Cash Flow

The funds raised can be used to improve Primo Industries’ cash flow. This can provide the company with greater financial flexibility and allow it to meet its financial obligations more easily.

Potential Risks

While the fundraising is expected to have a positive impact on Primo Industries’ financial statements, there are some potential risks associated with it.

- If the funds are not used wisely, they could lead to financial losses.

- The fundraising could dilute the ownership of existing shareholders.

- The fundraising could increase the company’s debt burden.

Growth Strategies

Primo Industries plans to implement a multifaceted growth strategy with the $105,000 raised. These strategies aim to enhance market penetration, expand product offerings, and optimize operational efficiency.

Market Penetration

- Increase brand awareness through targeted marketing campaigns and strategic partnerships.

- Expand distribution channels to reach new customer segments and increase product availability.

- Implement loyalty programs to foster customer retention and repeat purchases.

Product Expansion

- Develop new products that cater to evolving customer needs and market trends.

- Enhance existing products with innovative features and value-added services.

- Explore opportunities for cross-selling and up-selling to increase average order value.

Operational Optimization

- Implement lean manufacturing techniques to reduce production costs and improve efficiency.

- Invest in automation to enhance productivity and reduce labor expenses.

- Optimize supply chain management to minimize inventory levels and improve delivery times.

Timeline

The implementation of these growth strategies will be phased over the next 12-18 months. Market penetration initiatives will be prioritized in the short term, followed by product expansion and operational optimization efforts.

Potential Impact

These growth strategies are expected to have a significant impact on Primo Industries’ market position and profitability. Market penetration efforts will increase brand visibility, expand customer reach, and drive sales growth. Product expansion will allow the company to tap into new revenue streams and differentiate itself from competitors.

Operational optimization will enhance efficiency, reduce costs, and improve margins.

Impact on Stakeholders

The $105,000 fundraising will have a significant impact on various stakeholder groups associated with Primo Industries. These stakeholders include employees, customers, investors, suppliers, and the community.

The fundraising will provide the company with the necessary capital to implement its growth strategies, which are expected to have positive effects on all stakeholder groups. However, it is important to consider both the potential benefits and risks associated with the fundraising for each stakeholder group.

Employees

- Benefits:The fundraising will allow Primo Industries to invest in employee training and development, leading to increased job satisfaction and productivity.

- Risks:If the fundraising is not successful or if the funds are not used effectively, it could lead to job losses or reduced employee benefits.

Customers

- Benefits:The fundraising will enable Primo Industries to expand its product offerings and improve customer service, leading to increased customer satisfaction and loyalty.

- Risks:If the fundraising is not successful or if the funds are not used effectively, it could lead to reduced product quality or higher prices, negatively impacting customer satisfaction.

Investors

- Benefits:The fundraising will provide investors with an opportunity to invest in a growing company with strong potential for return on investment.

- Risks:The fundraising could dilute the value of existing shares if not managed properly, and there is always the risk that the company may not be able to meet its financial targets.

Suppliers

- Benefits:The fundraising will allow Primo Industries to increase its orders from suppliers, leading to increased revenue and profitability for suppliers.

- Risks:If the fundraising is not successful or if the funds are not used effectively, it could lead to reduced orders from Primo Industries, negatively impacting supplier revenue.

Community

- Benefits:The fundraising will allow Primo Industries to expand its operations and create new jobs, benefiting the local community.

- Risks:If the fundraising is not successful or if the funds are not used effectively, it could lead to reduced economic activity in the community.

Q&A

What will Primo Industries use the $105,000 for?

The $105,000 will be allocated to various initiatives, including product development, marketing and sales, and infrastructure expansion.

How will the funding impact Primo Industries’ financial performance?

The funding is expected to drive revenue growth, improve profitability, and enhance cash flow, strengthening Primo Industries’ financial position.

What are the potential risks associated with the fundraising?

As with any fundraising, there are potential risks, such as dilution of ownership and increased financial obligations. However, Primo Industries has carefully assessed these risks and believes that the benefits of the funding outweigh the potential drawbacks.